SBLC - Standby Letter of Credit

Standby Letter of Credit (SBLC) is a type of letter of credit (LC) where the issuing bank commits to pay to the beneficiary if the applicant fails to make the payment.

What is SBLC used for?

SBLCs, unlike other types of LCs, are a type of contingency plan. In the case of other LCs, the bank makes the payment first, and then the applicant pays the bank at a later date. However, when a bank issues an SBLC, they are only required to make the payment if the buyer or the applicant defaults.

Who can issue SBLC?

Any bank or NBFC can issue an SBLC once they are confident about the creditworthiness of the applicant. This is because the banks or the issuing institutions are exposed to the highest risk in the process.

What is the difference between LC, SBLC and Bank Guarantee?

The fundamental difference between a Letter of Credit and a standby letter of credit is the former can be encashed or discontinued during a trade transaction. While an SBLC is just a safety measure and is only encashed if any of the parties fail to honor the agreement, one cannot get an SBLC discounted if there is no default. Most trades are honored by all parties without any irregularities and hence the SBLC is discounted once the trade takes place.

On the other hand, while a bank guarantee only protects the buyer against a non-performing seller, SBLCs protect both the buyer and the seller – depending on the type of SBLC issued.

Advantages of SBLC

Bridges Trust Deficit

Lack of trust and fear of payment default is one of the key reasons why some international trade deal don’t take off. An SBLC is the best way to bridge the gap and ensure that all the worst-case scenarios are dealt with.

Serves as a great proof of creditworthiness

Once a reputable financial institution lends someone a standby letter of credit, they are practically making a statement about their and their company’s financial situation. This goes a long way in establishing creditworthiness.

Can help with business acquisition

Businesses that are just starting might fails to land big projects because they have no legacy to back them. Companies often get cold feet about working with such individuals or businesses. However, with an SBLC, they have a solid backing of a reputed financial institution and hence can successfully compete for prestigious contracts and big-ticket projects.

FAQs on SBLC

Is SBLC safe?

Standby Letters of Credit are highly secure documents that guarantee the payment for the goods in case the buyer defaults or is unable to pay as per the agreement.

How do you use SBLC?

An SBLC is used as a safety mechanism in a trade to ensure that the agreement is honored by both parties.

Can SBLC be confirmed?

Yes, an SBLC can be confirmed just like a normal letter of credit.

Can SBLC be canceled?

The SBLC is an irrevocable document and hence it cannot be canceled without the consent of all the parties involved.

Can SBLC be monetized?

Yes, SBLC can be monetized.

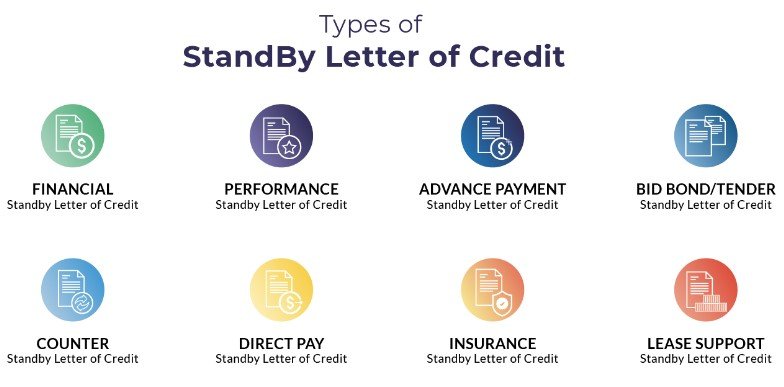

Financial Standby Letter of Credit

A financial SBLC guarantees payment to the seller or the service provider for the goods or the services rendered as per the agreement within the stipulated time frame.

Example: if an edible dye manufacture sends a shipment to a soft drink company against a financial SBLC, and the company is unable to pay for it, the issuing bank will step in and pay the manufacturer for the dye. Later on, the soft drink company would have to pay the full amount and interest to the issuing bank.

Performance Standby Letter of Credit

A performance SBLC is less commonly used compared to a financial SBLC. Performance SBLCs provide a guarantee of completion of a project as per the agreement or the contract. If the service provider fails to complete the project within a stipulated time frame, the bank steps in and reimburses the client.

Example: an IT company hires a contractor to construct a new office. The contractor agrees to complete the construction within a specific time frame but fails to deliver. However, if the deal is protected by a performance SBLC, the issuing bank will pay entire project fees to the IT company and will charge penalties to the contractor. This acts as a safety check that heavy budget projects are completed in a timely fashion.

Advance Payment SBLC

Advance Placement Standby LC provides security against one party’s failure to pay the other party’s advance payment.

Bid Bond/Tender SBLC

Bid Bond/Tender Standby LCs act as a security against failure to complete the project once the applicant has been awarded the bid or the tender for it.

Counter SBLC

Also known as a backstop or a protective standby, Counter SBLC is a type of LC issued by a bank in one country to a bank in another country, asking them to issue a new standby LC to their local beneficiary.

Direct Pay SBLC

Direct Pay SBLCs act as a security in the instance of financial instability of the applicant. A direct pay standby is irrevocable.

Insurance SBLC

Insurance SBLC provides support to the beneficiary in case the applicant has committed for insurance or insurance but fails to do so.

Lease Support SBLC

A Lease Support SBLC is issued by the bank representing the tenant to the landlord. The bank generally takes a deposit as collateral for the SBLC. It pledges to pay the rent to the landlord in case the tenant is not able to do so.

How much does an SBLC cost?

Of the total SBLC amount, banks charge about 1% to 10% as annual fees—depending on the risks and the amounts. The charges are applicable as long as the SBLC is valid.